Breaking News

- Davos Talks Highlight NATO Tensions After Trump Revives Greenland Issue

- Wild Landscapes and a Celebrity Koala: A Journey Across an Australian Island

- AI Can Boost Civil Liberties, Palantir CEO Says, as Europe Slips Behind Global Rivals

- Dolphins’ QB Future Becomes Clear as Ex-Packers Coach and GM Shape Direction

- Trump’s Threats Toward Greenland Raise Fears of U.S. Expansionism

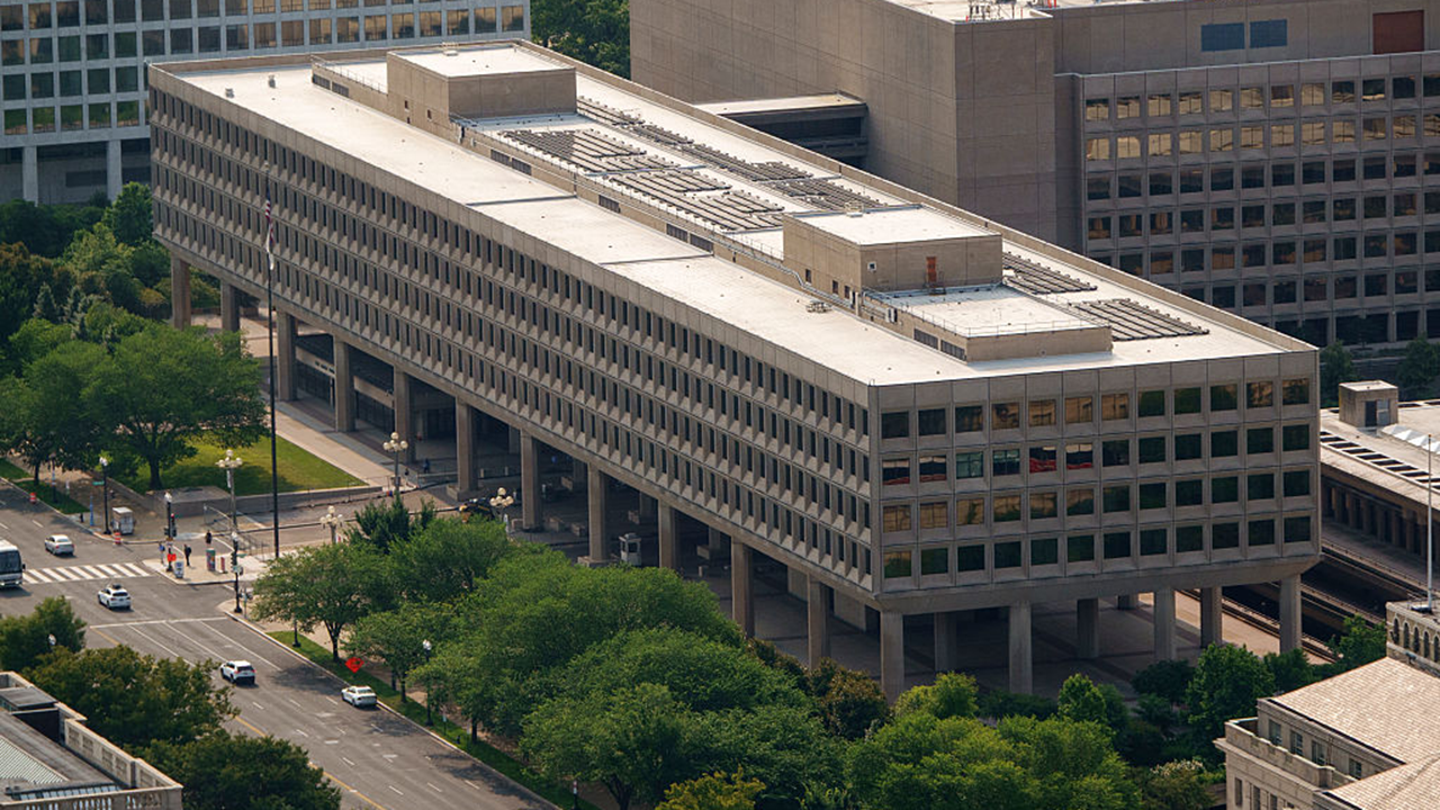

- FDA Gives Green Light to First At-Home Brain Therapy Device for Depression

- Your Go-To Restaurant Won’t Last Forever. Here’s How to Handle It

- Washington’s Millionaire Tax Proposal Raises Fears of Wider Taxes and Economic Fallout

- Brooklyn Beckham Says Parents Declined Meeting After He Traveled to London for Reconciliation

- China’s Population Growth Crisis Deepens as Birthrate Hits 1949-Era Low

- 5 Hidden Maryland Islands That Feel Like a Quiet Slice of Paradise

- Musk’s xAI Closes $20 Billion Raise to Fuel AI Expansion