Nvidia’s AI Chip Empire Keeps Breaking Records

The company powering much of the artificial intelligence revolution is still minting money. Nvidia, whose chips are at the heart of today’s A.I. systems, said its latest quarterly revenue climbed to $57 billion, underscoring just how intense global demand has become.

Profits Surge as AI Demand Explodes

Just three weeks after Nvidia briefly became the first publicly traded company to top $5 trillion in market value, the chipmaker offered fresh proof of its dominance.

In its most recent quarter, Nvidia reported profit of $31.9 billion, up 65 percent from a year earlier and 245 percent from two years ago. Among big tech peers, only Alphabet, Google’s parent company, earned more in the same period.

Nvidia now commands an estimated 90 percent share of the market for chips that power A.I. models and data centers. That grip has turned the company into a key indicator for the rest of the tech industry, which is pouring trillions of dollars into massive computing facilities around the world.

A Test for Wall Street’s Nerves

The company’s staggering profits arrive at a tense moment in financial markets. Investors have grown worried that spending on A.I. infrastructure may be outpacing real-world demand for the technology.

Since Nvidia crossed the $5 trillion mark, the S&P 500 has fallen 3.6 percent, and Nvidia’s own shares are down 10 percent in that stretch—though they remain 34 percent higher for the year.

The latest results may ease some of those concerns. In the quarter that ended in October, Nvidia said sales of its A.I. data center chips jumped 44 percent to $51 billion, pushing total revenue to $57 billion, ahead of Wall Street’s expectation of $55.2 billion.

Growth Shows No Signs of Slowing

Nvidia also signaled that its expansion is far from over. It projected that current-quarter revenue will jump 65 percent from a year earlier to $65 billion, well above analysts’ estimates of $57 billion.

The company pointed to surging demand for its newest “Blackwell” chips and other cloud graphics processing units, or GPUs.

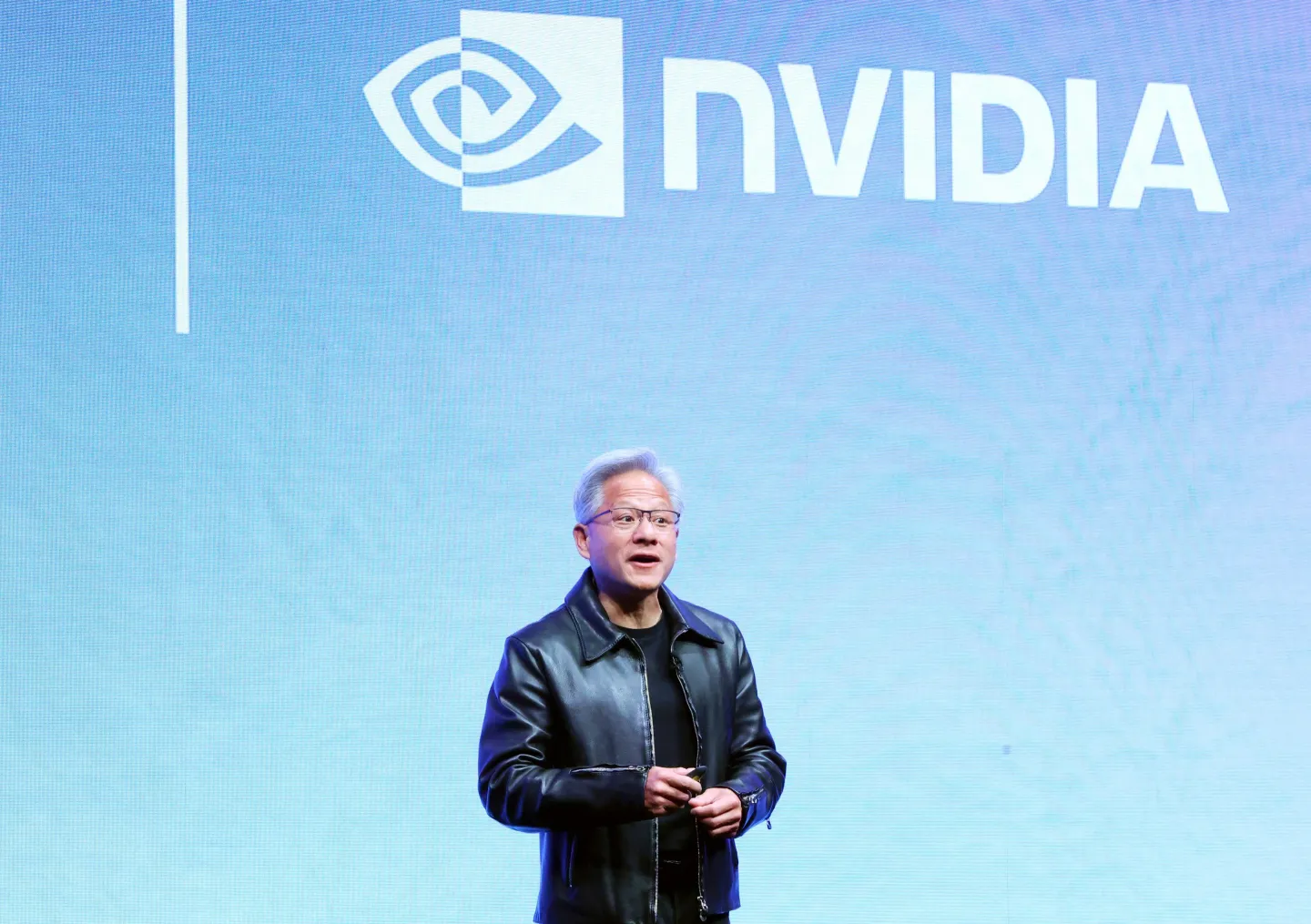

“Blackwell sales are off the charts, and cloud GPUs are sold out,”

said Jensen Huang, Nvidia’s chief executive and co-founder, in a statement.

“Compute demand keeps accelerating.”

Shares rose more than 3 percent in after-hours trading following the report.

‘Circular’ Deals With AI Start-Ups Raise Questions

Despite the strong numbers, Nvidia has unsettled some investors with the way it finances a portion of its growth. The company has begun investing directly in several major A.I. start-ups that also happen to be huge customers for its chips.

Nvidia has said it plans to invest $100 billion in OpenAI, the maker of ChatGPT. The start-up, in turn, uses that money to buy or lease Nvidia’s hardware. On Tuesday, Nvidia unveiled a similar arrangement with Anthropic: Nvidia will invest $10 billion, and Anthropic will purchase $30 billion of computing services powered by Nvidia chips.

Goldman Sachs has estimated that roughly 15 percent of Nvidia’s sales next year could come from these kinds of arrangements, which critics have labeled “circular” deals.

“The fundamentals for the company are still intact, but you have these clouds that keep popping up,” said Daniel Morgan, a senior portfolio manager at Synovus.

Mr. Huang has defended the approach. At a news briefing in Washington last month, he said Nvidia had not yet deployed any of the $100 billion committed to OpenAI. Instead, he called it an invitation to invest gradually “along the way” as OpenAI grows and moves toward a potential public offering.

Rivals and Geopolitics Complicate the Picture

Nvidia’s commanding lead is also being tested by rising competition and political tensions.

AMD has been rolling out its own high-performance A.I. chips and recently struck a deal with OpenAI. Qualcomm has announced an agreement to sell its A.I. products to Saudi Arabia, highlighting how other chipmakers are pushing into the same lucrative market.

Even as those rivals ramp up, Nvidia has outlined an aggressive future. Mr. Huang recently said the company expects $500 billion in sales through the end of next year, more than double what it generated in the prior two years.

China Market Blocked by Security Concerns

One of Nvidia’s major challenges is China. The company is barred from selling some of its most advanced chips there, and Beijing has discouraged Chinese firms from buying its products, limiting Nvidia’s access to the world’s biggest semiconductor market.

Mr. Huang had been trying to win U.S. approval to sell Nvidia’s latest chips to Chinese customers while also urging Beijing to loosen restrictions. But when former President Donald Trump recently met with China’s leader, Xi Jinping, his advisers urged him not to intervene over national security concerns.

Instead, Mr. Trump told Mr. Huang that he would need to negotiate directly with Chinese officials.

Despite those hurdles, Nvidia’s latest results suggest that, for now, the A.I. boom is still more than enough to fuel its extraordinary run.