A Look at Trump’s Latest Global Tariffs

28.07.2025

Trump Launches Aggressive Tariff Campaign Targeting Global Trade

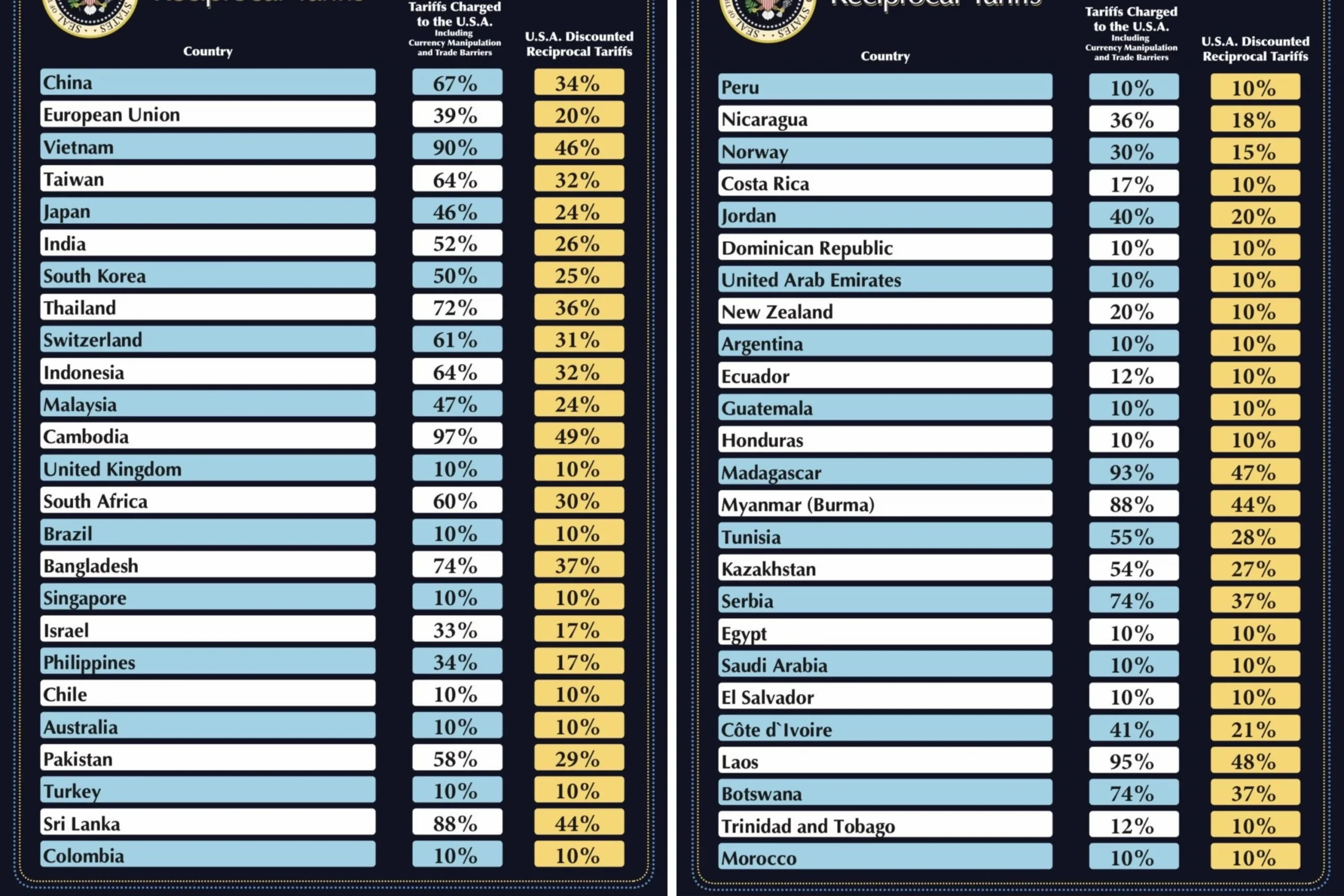

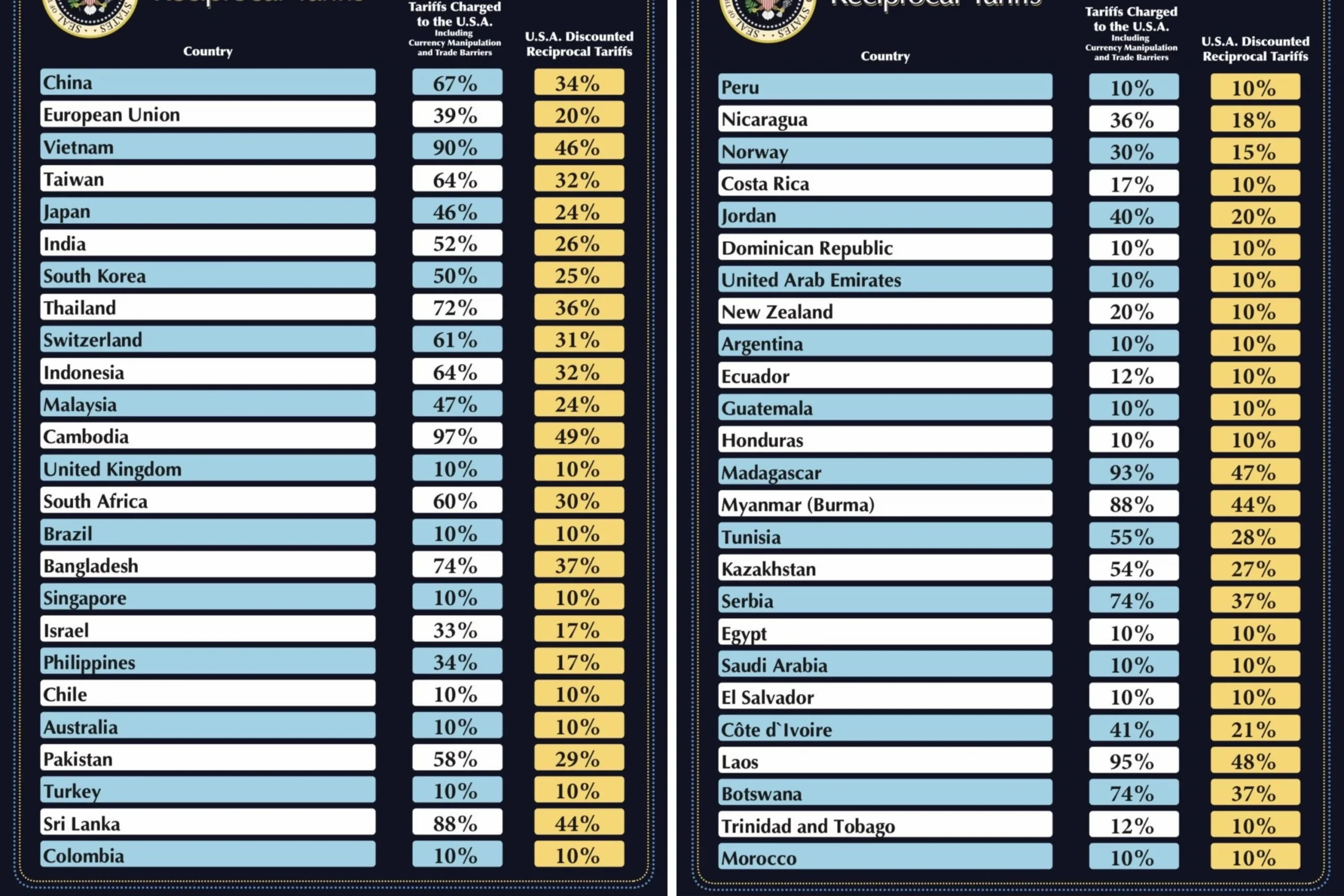

Since returning to office, President Donald Trump has initiated a sweeping and highly aggressive trade agenda, imposing substantial tariffs on a wide range of countries — both allies and rivals. His goal: to overhaul the global trade system, generate new federal revenue, and incentivize American companies to manufacture more products domestically.

This renewed trade war marks one of the most ambitious and contentious moves in modern U.S. economic policy. While its full impact remains to be seen, its consequences for American businesses, consumers, and global trade partners are already drawing global attention.

A New Wave of Tariffs Begins August 1

Starting August 1, the U.S. is poised to enact a new set of tariffs affecting numerous countries. Import duties — some reaching as high as 50 percent — will apply to a wide range of goods, with Canada and Mexico among those hit hardest. These tariffs are in addition to those already enforced or agreed upon in recent trade negotiations.

Countries affected include those who recently received formal notices from the U.S. outlining the new tariff levels unless a last-minute trade compromise can be reached. For instance, tariffs on imports from South Korea are set at 25 percent, Thailand’s goods will be taxed at 36 percent, and Brazil faces the steepest increase at 50 percent.

Trump’s decision to target Brazil stems from political grievances, including criticism of Brazilian leaders over their treatment of former President Jair Bolsonaro, a known Trump ally.

Retaliation Warnings and Trade Strategy

In each country-specific communication, Trump has made clear that retaliatory actions would be met with even harsher tariffs. He emphasized that these new duties are separate from those aimed at specific industries or products, and instead are calculated using a “reciprocal” formula based on trade deficits — a method widely questioned by economists.

Initially, Trump paused the tariffs for 90 days in an effort to forge deals quickly. This deadline has since been extended, but the White House maintains that implementation will begin on August 1, unless otherwise specified. For China, which negotiated a special arrangement, the deadline is set for August 12.

New Trade Deals and Partial Concessions

While the majority of nations are bracing for higher tariffs, several countries have managed to secure trade agreements with the U.S. to lower or restructure these duties. The European Union, for example, agreed to a preliminary deal setting its tariff rate at 15 percent in exchange for improved access to U.S. markets.

Japan also reached an agreement with the Trump administration, accepting a 15 percent tariff on its exports while gaining relief from prior auto-related tariffs. In return, Japan pledged $550 billion in investments in the United States.

Similar frameworks have been announced with the United Kingdom, Vietnam, the Philippines, and Indonesia — the latter agreeing to a 19 percent tariff rate.

Tariff Pressures on Major Trading Partners

Canada and Mexico — long-standing trading partners — are facing increased duties as well. Starting August 1, Canada may see tariffs as high as 35 percent, and Mexico 30 percent. These rates would apply to goods not covered by the U.S.-Mexico-Canada Agreement (USMCA), which Trump signed during his first term.

In February, Trump proposed a 25 percent blanket import tax on all goods from both countries, citing their alleged lack of cooperation in combating fentanyl trafficking. That policy was temporarily softened after significant opposition but may now be partially revived in a revised form.

Industry-Specific Tariffs Expand

Beyond country-level tariffs, the Trump administration continues to apply duties to specific industries, including aluminum, automobiles, steel, and auto parts. These are often justified under Section 232 of federal trade law, which allows for tariffs on national security grounds.

Some of these sector-specific tariffs stack on top of country-based ones, while in other cases, trade agreements override the individual duties. The administration is also preparing to target new sectors such as copper, pharmaceuticals, and semiconductors.

In total, the vast majority of imports entering the United States are now subject to elevated tariffs, creating ripple effects for businesses and consumers alike.

Consumer Impact and Market Risks

While the administration argues that foreign producers will bear the burden of the tariffs, most economists warn that the added costs will be passed along to American companies and consumers. This means higher prices for goods and increased uncertainty for businesses reliant on global supply chains.

Despite these concerns, Trump appears committed to maintaining pressure through tariffs, describing them as essential tools for securing fair trade. His team has reiterated that the August 1 deadlines will not be postponed further, even though in the past, Trump has reversed course to allow more time for deal-making.

As this new chapter in U.S. trade policy unfolds, the global economy watches closely — with questions still looming over whether these high-stakes tactics will bring long-term gains or lasting disruption.