Nvidia Reaches $5 Trillion: The Titan of the A.I. Era

30.10.2025

From Silicon Valley to the World Stage

Nvidia has officially crossed the $5 trillion valuation mark — a milestone that redefines not only Silicon Valley’s hierarchy but also the balance of global power in the age of artificial intelligence.

As CEO Jensen Huang landed in Asia to meet with President Trump, the company’s value surged again, symbolizing how a chipmaker has become the epicenter of both the digital economy and international diplomacy.

A few years ago, such wealth would have seemed implausible. But that was before ChatGPT triggered a worldwide A.I. race, forcing every tech giant to invest hundreds of billions in computing infrastructure. Nvidia’s processors — the irreplaceable core of these A.I. systems — now power an economy that’s reshaping trade, innovation, and even geopolitics.

The Heartbeat of America’s Economic Growth

In the first half of this year, data center investments — largely fueled by Nvidia’s chips — accounted for 92% of U.S. GDP growth, according to Harvard economist Jason Furman. Without that surge, America’s growth would have been almost flat.

In just four months, Nvidia added another $1 trillion in market value, becoming the first public company in history to surpass the $5 trillion mark.

But this growth also raises concerns. Financial analysts warn that Wall Street’s dependence on a handful of A.I.-driven companies — Nvidia, Apple, Microsoft, and Meta — may leave the market dangerously top-heavy.

“There’s unbridled optimism,” said Gene Munster of Deepwater Asset Management. “But the question is: Will it deliver? A.I.’s usefulness is still limited today.”

A Chipmaker Turned Diplomatic Tool

Nvidia’s dominance — with over 90% of the global A.I. chip market — has made it an unlikely yet crucial player in international trade strategy. The Trump administration now treats Nvidia’s chips as a strategic export, using them in negotiations with countries like Japan, South Korea, and the United Arab Emirates.

During his Asia tour, President Trump suggested that Nvidia’s “Blackwell” chip could become a key topic in U.S.–China trade talks. Relations between the two superpowers remain tense, as Washington blocks chip sales over security concerns while Beijing accelerates its own A.I. ambitions.

Huang, 62, has become an informal intermediary between Washington and Beijing, navigating policy shifts with rare finesse.

“Nvidia works with governments across the world,” said company spokesman John Rizzo. “We do not engage in geopolitical negotiations.”

A New Industrial Alliance

To curry favor in Washington, Nvidia has relocated part of its production to the United States. The new “Blackwell” chip is now being manufactured at TSMC’s Arizona plant — a symbolic win for the administration’s “Made in America” initiative.

Last week, Huang personally presented Trump with a red-cased Blackwell chip in the Oval Office. The president called him “brilliant” and praised the company’s role in America’s tech leadership.

If allowed back into the Chinese market, Nvidia could generate $50 billion in sales over the next year, analysts estimate. As part of a July agreement, the company will pay 15% of its China revenues to the U.S. government — a compromise between open trade and national security.

The A.I. Gold Rush — Promise or Mirage?

At Nvidia’s latest conference in Washington, Huang compared artificial intelligence to “electricity and the internet” — a universal utility for the future.

“Every company will use it. Every nation will build it,” he declared to thousands of attendees.

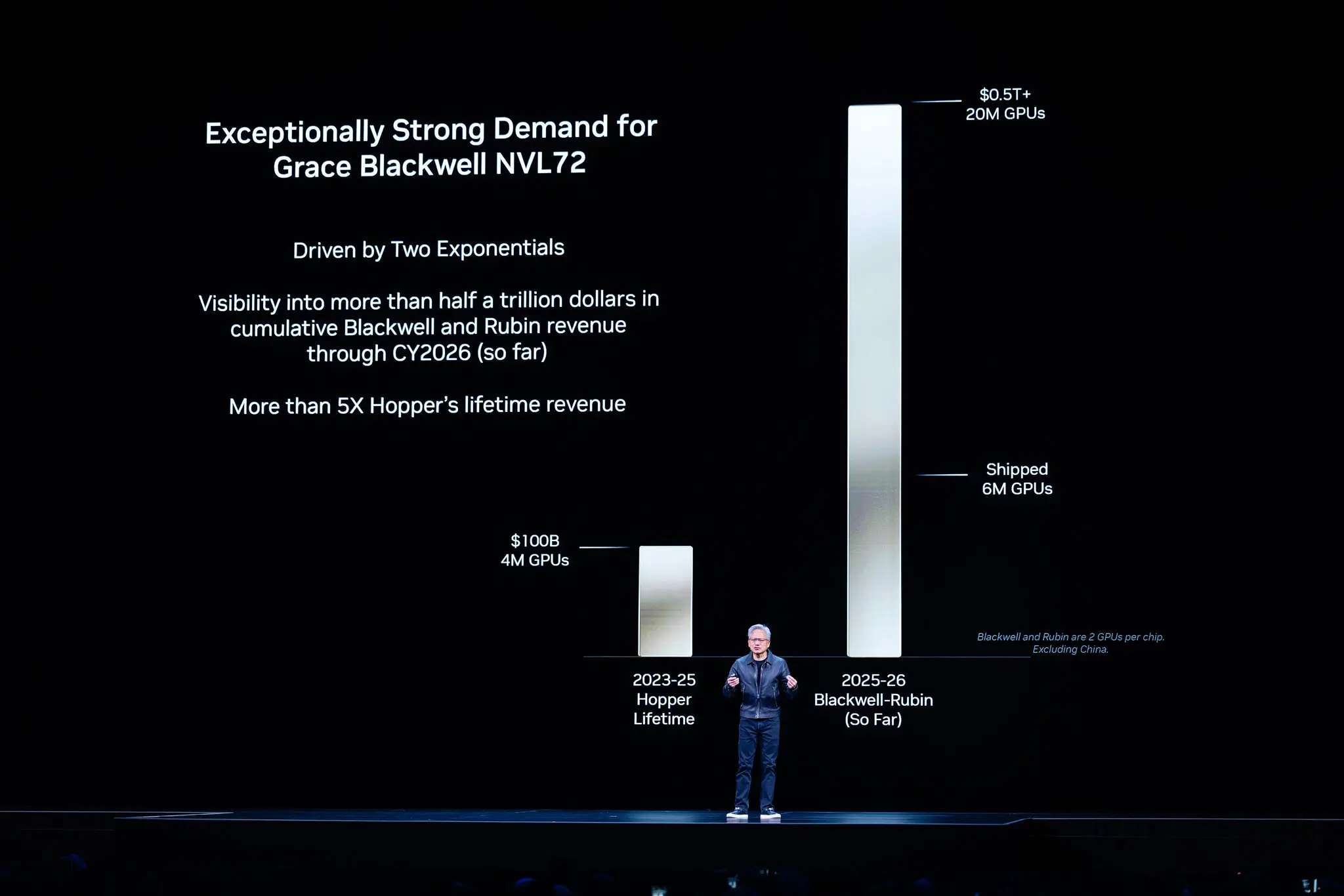

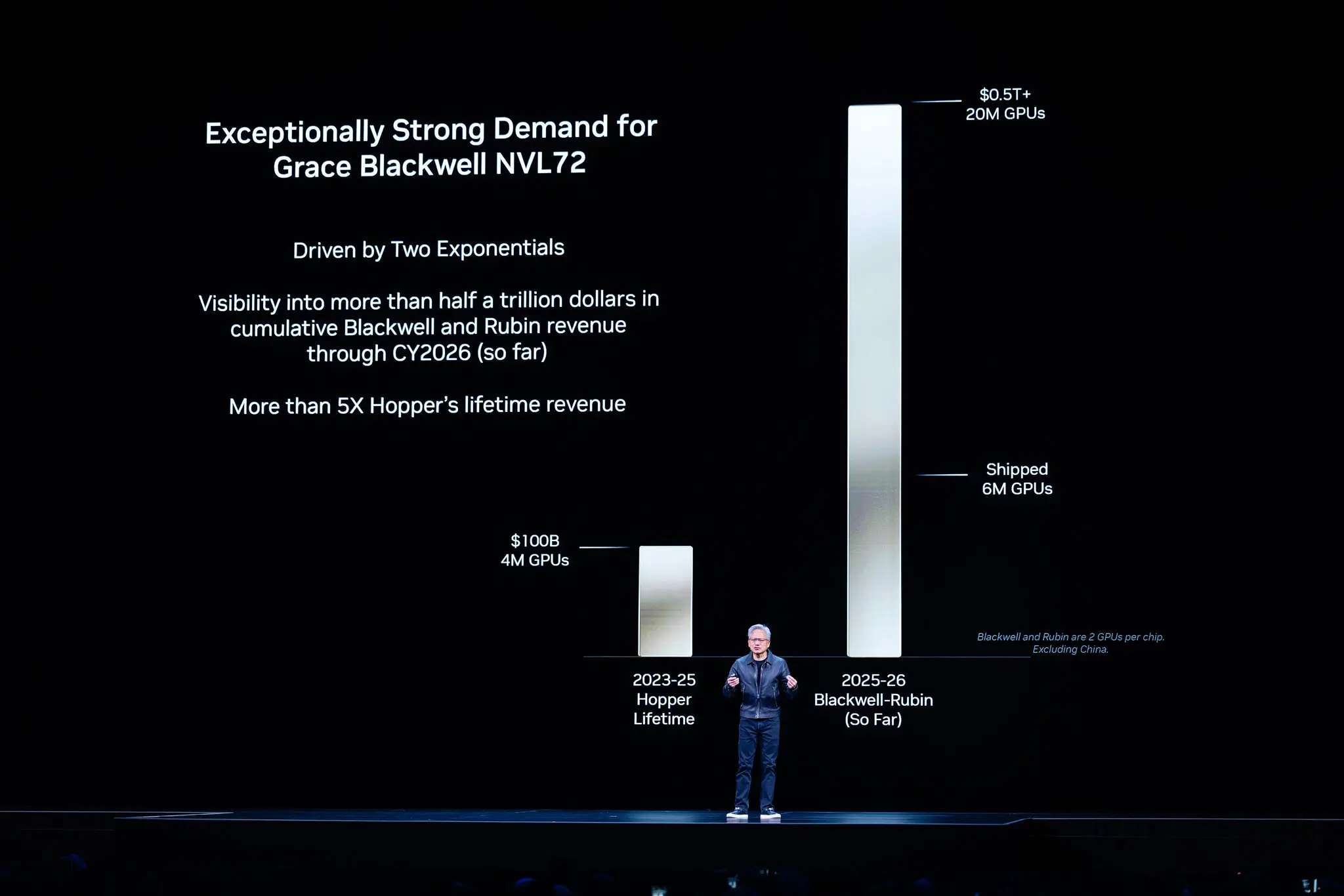

Companies like Microsoft, Oracle, and Amazon are already spending over $549 billion on data centers — more than double last year’s figure. Nvidia expects to ship 20 million new-generation chips by the end of next year, generating roughly $500 billion in revenue.

Yet the frenzy has drawn skepticism. Critics question whether current A.I. systems can deliver productivity gains that justify such spending.

“We’re still early,” said Bob O’Donnell of TECHnalysis Research. “Turning demos into real-world transformation is taking longer than anyone expected.”

The Paradox of Power

Nvidia’s meteoric rise mirrors a paradox of modern capitalism: the same innovation driving economic growth is also concentrating power in unprecedented ways. As nations compete for A.I. dominance, one company stands at the crossroads of markets, politics, and ideology — a trillion-dollar empire built on silicon and ambition.